Will vs. Deed of Gift: What’s the Best Way to Transfer Property to Family in Nigeria?

In Nigeria, choosing the best way to transfer property to family is more than just a legal step, it’s a deeply personal decision that can impact your loved ones long after you’re gone. Whether you’re thinking about using a Will or a Deed of Gift, the goal is often the same: to ensure a smooth transfer of property, avoid disputes, and protect family relationships. But each method comes with its own rules, risks, and legal weight. Understanding how they work is key to deciding the best way to transfer property to family in Nigeria without leaving room for confusion or conflict later on.

What is a Will and How Does It Work in Nigeria?

When you think about the best way to transfer property to family in Nigeria, writing a Will is usually the first option that comes to mind. It’s a familiar concept, something we hear about in movies, in conversations, and sometimes during family meetings. But what exactly is it?

A will is a legal document that specifies a wish regarding the distribution of properties and assets and the care of any dependents after death.

You clearly state what should happen to your belongings including land, houses, money, and even personal items after you die. The person who writes the Will is called the testator, and they get to name specific individuals (called beneficiaries) who will receive each asset.

In Nigeria, a Will is recognized under the law, and when properly written and registered, it can help prevent unnecessary confusion or disputes among family members after death. It gives you a voice even when you’re no longer around.

Why Some People Choose a Will

One of the biggest benefits of using a Will as a means of transferring property is the flexibility it gives you. Life happens, relationships change, new assets are acquired, people pass away. A Will allows you to go back and make changes when necessary, as long as you’re still alive and mentally sound (It is revocable).

Also, a Will gives you the opportunity to take a comprehensive approach to estate planning. You’re not just transferring one plot of land or one house you can include everything you own, from multiple properties to vehicles, shares, and even instructions on how your children should be cared for.

So if you’re looking for the best way to transfer property to family in Nigeria and you want the ability to stay in control until the end of your life, a Will can be the right fit.

But There Are Some Drawbacks to Consider

The major downside to relying on a Will is the probate process. This is the legal procedure your family must go through after your death to validate the Will and officially transfer the assets. Unfortunately, probate can take months or even years, especially if there are disputes. It can also be costly, with court fees and lawyer charges eating into your estate.

And here’s where things get tricky. Wills can be challenged. If a family member feels left out or believes the Will wasn’t properly written, they can go to court and contest it. This often leads to long-drawn battles that can divide families and delay the property transfer process.

What is a Deed of Gift and How Does It Work in Nigeria?

If you’re thinking about the best way to transfer property to family in Nigeria while you’re still alive, then the Deed of Gift is one option you definitely need to consider.

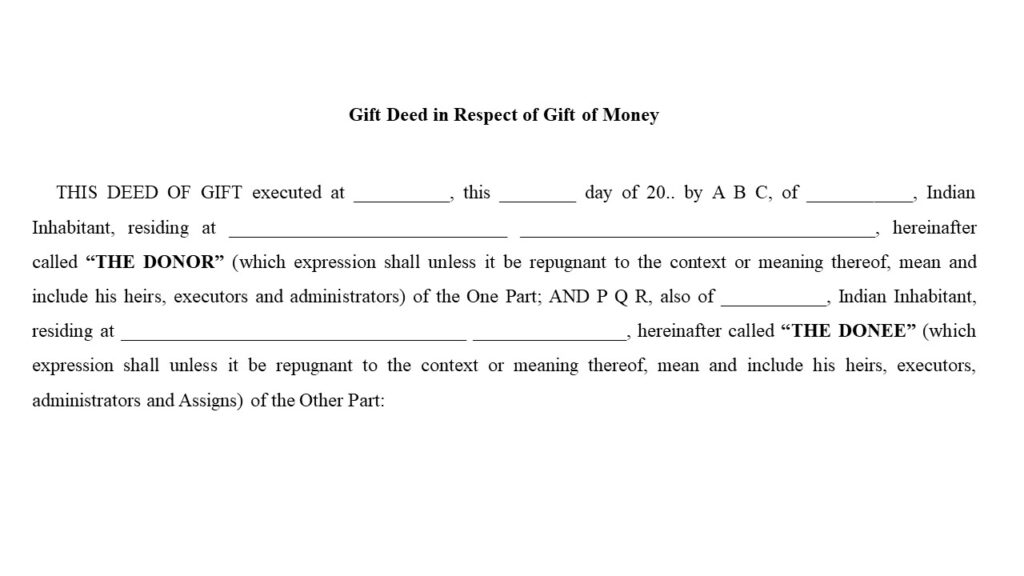

A Deed of Gift is a legal document that transfers property to another individual or entity as a gift rather without monetary value.

It allows you (the donor) to give your property like land or a house to someone else (the donee) as a gift. And the key thing here is that this is done without any money involved. You’re giving it freely, and you’re doing it while you’re still alive.

So unlike a Will, which only takes effect after you’ve passed away, a Deed of Gift is immediate. Once it’s signed and properly registered, the property belongs to the new owner for good ( it is irrevocable).

What Makes a Deed of Gift Different?

The most important thing to know about a Deed of Gift is that it is irrevocable. Once you’ve signed it and it’s been registered, that’s it. You can’t change your mind later and try to take the property back. Even if you had a falling out with the person or things changed in your relationship, the law won’t allow you to undo it.

This can be a huge advantage when it comes to avoiding future family drama. One reason many people are beginning to prefer this method when considering the best way to transfer property to family in Nigeria is because it reduces the chances of disputes after death. If the gift has already been given and legally recorded, there’s really nothing to fight over when the person dies.

What Do You Need to Create a Deed of Gift in Nigeria?

Like any legal process in Nigeria, there are a few things that need to be in place for your Deed of Gift to be valid:

- Proper Documentation

The deed must be written down and must clearly state the names of the donor and donee, a full description of the property, and confirmation that the gift is being given voluntarily. It should also state that no money is being exchanged.

Because of the Land Use Act of 1978, you can’t legally transfer land or real estate in Nigeria without getting the approval (or consent) of the state governor. This step makes the transfer official and legally binding.

- Registration

Once the deed is created and consent is obtained, it needs to be registered at the land registry. This final step ensures that the donee’s name is officially on record as the owner of the property.

Without completing these legal steps, the gift may not hold up if challenged in court.

Which is Better: Will or Deed of Gift?

Now that we’ve broken down what both options really mean, let’s talk about the big question: what’s the best way to transfer property to family in Nigeria?

Truth is, it depends on what matters most to you.

If you like the idea of staying in control of your property for as long as possible and you want the freedom to make changes as life happens, then a Will gives you that flexibility. You can decide who gets what, add or remove names, or rewrite the whole thing if you need to. It’s ideal for people who want to handle everything at once real estate, money, possessions, even guardianship of kids all in one document. But you have to be ready for the probate process that comes with it, and understand that even a well-written Will can be challenged in court by unhappy family members.

On the other hand, if your main concern is avoiding family conflict after death and ensuring that your wishes are respected without interference, a Deed of Gift offers peace of mind. The moment it’s signed and registered, the property officially belongs to the recipient. No one can alter it not you, not a lawyer, not even the court. This is especially useful if you already know exactly what you want to give, and to whom. But keep in mind it’s final. There’s no going back once it’s done, even if things change later except there was a termination clause included in it.

In many Nigerian families, the fight after someone dies isn’t always about what was written in the Will it’s about who can manipulate the system to benefit themselves. That’s why more people are now leaning towards the Deed of Gift, especially when it comes to land and houses. It minimizes uncertainty and closes the door to legal disputes before they even begin.

So what’s the best way to transfer property to family in Nigeria?

If you’re planning for the future and still want room to adjust things, go with a Will but make sure it’s properly written, registered, and updated regularly.

If you’re sure of your decision and want to avoid drama completely, a Deed of Gift might be the better path.

Conclusion

When it comes to securing your legacy and protecting your loved ones, there’s no one-size-fits-all answer. The best way to transfer property to family in Nigeria depends on your unique situation, your relationships, and how much control you want to retain while you’re alive.

If flexibility and full estate planning matter most to you, a Will might be the way to go. But if your priority is to lock things in and avoid any future disputes or interference, then a Deed of Gift offers stronger legal finality.

Whichever option you choose, don’t leave it to chance. Get proper legal guidance, complete the right documentation, and most importantly make your intentions clear while you’re still here. Because in the end, the goal isn’t just to transfer property, it’s to pass on peace.

Note: This blog post is for informational purposes only and does not constitute legal advice. Always consult with a qualified legal professional for personalized guidance.